Modernising Transaction Banking

Empowering over 10 Billion daily transactions with unmatched efficiency powered by scalable microservices and Open banking APIs aligned to industry sectors

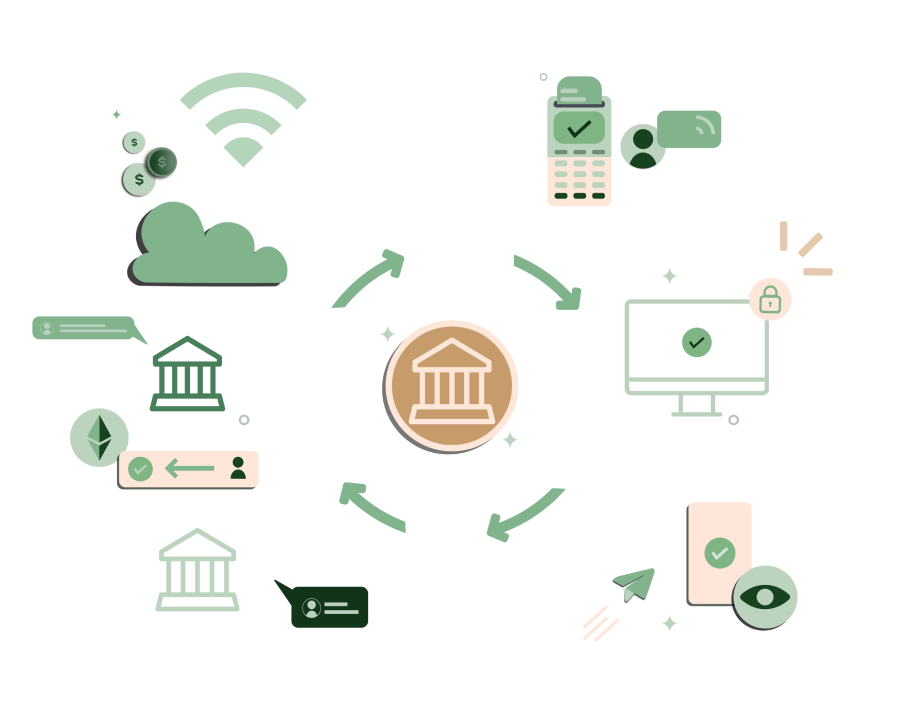

Change the face of Transaction Banking with a comprehensive integrated front-to-back platform

What’s in it for...

Change the game in SME banking and increase the stickiness of your clients by offering a full suite of products specifically tailored to increase customer loyalty and acquire new clients

Higher cost savings powered by digital technology leads to additional budgets that can be used to focus on enhancing customer experience

Market and promote a bouquet of products that can be used for up-selling and cross-selling to corporates available across domains

Eliminate the grind of multiple changes in core banking or other systems and be able to provide better business benefits with higher efficiency and reduced costs

Experience the convenience of hyper-personalised visual dashboards, offering real-time insights for swift decision-making, and view all bank services in one easily navigable interface for enhanced user experience.

The versatile DTB product suite offers tailored banking solutions, expertly crafted to cater to the varied needs of industry sectors and customer segments, ranging from SMEs to multinational corporations.

Office in your pocket: Get the all-new ANYTIME ANYWHERE mobile banking experience designed specifically for SMEs to speed-up banking interactions and transact at scale.

Next Gen Industry Aligned Wholesale Banking

A composable, cloud-native, integrated transaction banking platform powered by microservices and open banking APIs, eMACH.ai Digital Transaction Banking (DTB) covers the working capital cycle from accounts services, payments, liquidity, collections, virtual accounts, trade & supply chain finance.

Intellect’s fully managed, cloud-ready Digital Transaction Banking Platform will help de-risk banks’ IT operations with up to 40% reduction in IT total cost of operations (TCO).

Pre-configured domain packs will speed up the bank’s go-to-market product launch aided by an operationally-ready suite of 135+ Open Banking APIs to help roll out consumer-friendly innovative features. Corporates and SMEs can be rapidly onboarded, saving up to 70% in onboarding costs, bringing in operational efficiency, and driving down acquisition costs. All this is backed by pay-as-you-grow ready plans that can help banks go live in as fast as 10 weeks, leveraging our global cloud infrastructure from Microsoft Azure.

eMACH.ai DTB Value Accelerators

Insights

What's trending in Digital Transaction Banking

Start Your Journey with Digital Transaction Banking

Interested in learning more about DTB? Discover all the details here!